A Pre-Series health tech startup based in New York City, backed by ~USD 20 million in funding, approached AND with a clear need—its existing financial model lacked the structure and depth to support decision-making in a fast-moving market. The previous framework failed to differentiate revenue streams or accurately forecast cash flow, creating roadblocks in strategic planning and investor communication.

To support the client's growth and funding ambitions, our engagement focused on the following:

Our comprehensive approach involved:

Deep-Dive Review: Analysed historical financial data and mapped key revenue drivers across business lines

Modular Financial Architecture: Built dedicated modules for each revenue stream, tailored to their billing cycles and pricing structures

Scenario-Based Forecasting: Integrated dynamic scenario analysis to simulate multiple growth paths and their financial impact

Operational Alignment: Incorporated Sales and Operations Planning (SNOP) to account for scaling costs and future investment needs

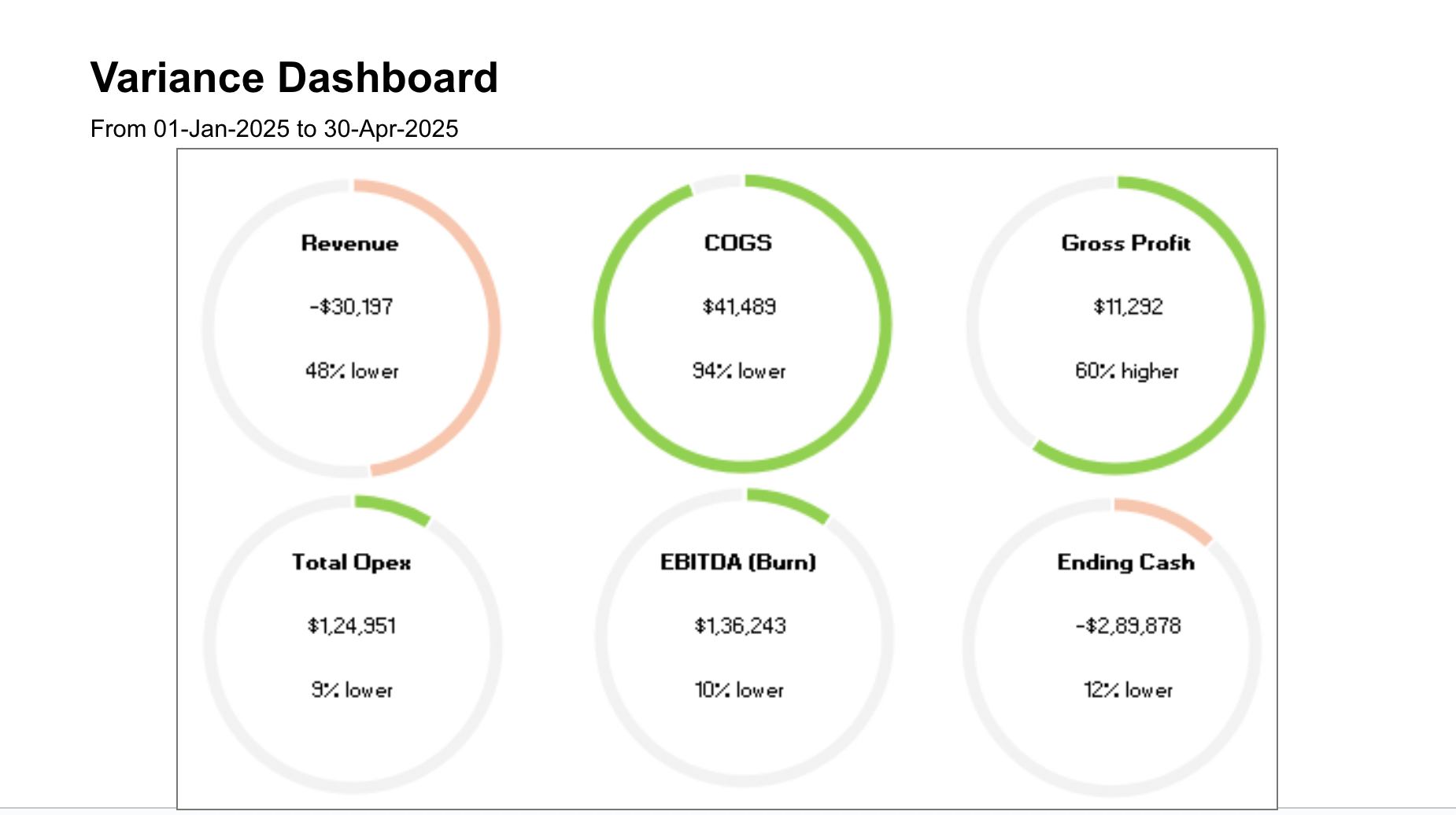

Dashboard and SOP Development: Delivered real-time dashboards for leadership use and documented SOPs to standardize reporting and data handling

Our work gave the client more than just a spreadsheet—it delivered a decision-making engine. The model became central to investor conversations and operational planning, helping leadership clearly understand their financial runway, refine their capital strategy, and make faster, better-informed decisions.

The improved clarity supported a successful raise of ~USD 15 million in follow-on funding and led the client to onboard AND as their fractional FP&A partner. With ongoing model enhancements and financial advisory, we continue to support the client's strategic agility in an ever-evolving health tech landscape.

At AND, we didn't just build a model—we created a foundation for smarter decisions, confident fundraising, and scalable growth.

Financial modeling for health tech startups involves building comprehensive, modular financial frameworks that support decision-making, investor communication, and operational planning in fast-moving markets.

Financial modeling provides startups with cash flow visibility, scenario planning capabilities, and investor-ready frameworks to support funding strategies and strategic decision-making.

AND provides comprehensive financial modeling including modular architecture, scenario-based forecasting, operational alignment, and dashboard development for health tech startups.