A global financial services firm with over $20 billion annual revenue was establishing new entities to offer operating and financial leases for electric vehicles. They needed two independent financial models:

While the models served different purposes, both needed to accommodate a wide range of variables and be robust enough to support evolving business needs.

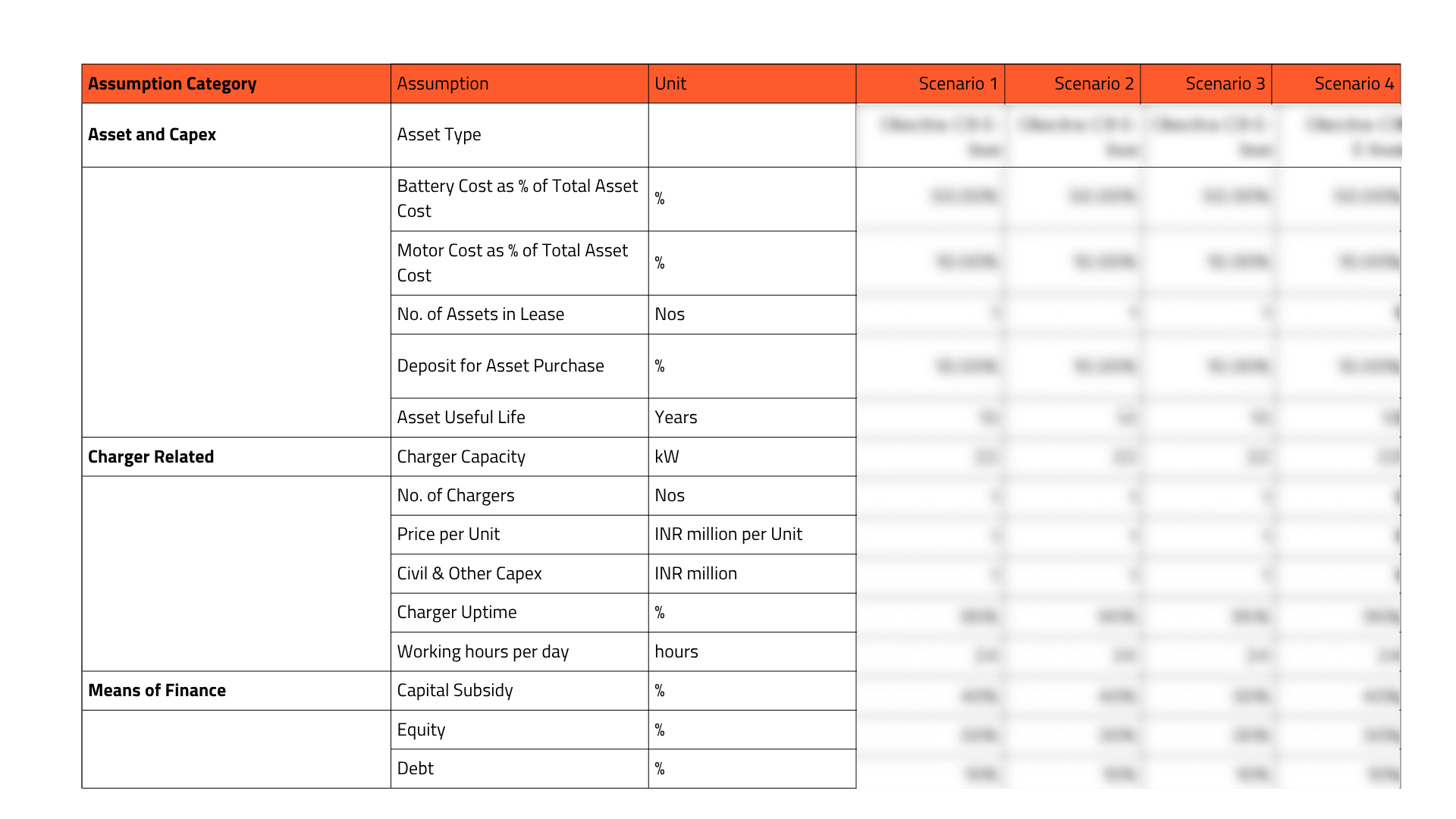

We developed a detailed lease-level model to assess the pricing and viability of individual operating and financial leases. This 20-year quarterly model handled a variety of input scenarios, lease structures, and financing combinations, providing clear visibility into unit economics and transaction-level profitability.

In parallel, we built an independent platform-level model that could simulate business performance under different growth and funding scenarios. This model did not rely on aggregation from the lease model but was designed from the ground up to reflect portfolio dynamics and capital needs - making it scalable, adaptable, and presentation-ready for investment committees.

Scenario tools, sensitivity analysis, and intuitive dashboards were built into both models to support faster, more informed decisions. Each model was fit-for-purpose - detailed where required and streamlined where needed for executive use.

Together, the two models gave the client the tools to manage both day-to-day operations and long-term strategy. The individual lease-level model ensured accurate pricing and viability assessment across a wide range of transaction types, while the platform model supported forward-looking analysis of profitability, funding needs, and capital deployment. Built-in scenario and sensitivity tools enabled better risk evaluation and planning, and interactive dashboards made the models easy to use across teams—from finance to strategy to operations.

AND helped the client build a solid financial foundation—sharp on the details, clear on the big picture. By grounding every transaction and growth scenario in rigorous, adaptable models, we empowered the client to lead their EV leasing venture with precision, confidence, and foresight.

EV leasing financial modeling involves creating detailed financial models to evaluate individual lease transactions and overall business performance for electric vehicle leasing operations.

Dual models provide both transaction-level precision for day-to-day operations and platform-level insights for strategic planning and investment decisions.

AND develops comprehensive financial models, scenario analysis tools, and interactive dashboards to support EV leasing businesses from transaction evaluation to strategic planning.