A global online learning platform serving more than 5 million learners worldwide engaged us to revamp and institutionalize their FP&A and finance operations functions. At the outset, the client's financial operations were disorganized, with inconsistent data sources, scattered systems, and no unified framework for financial planning, leading to delays and inefficiencies. In this context, the client turned to AND for support to:

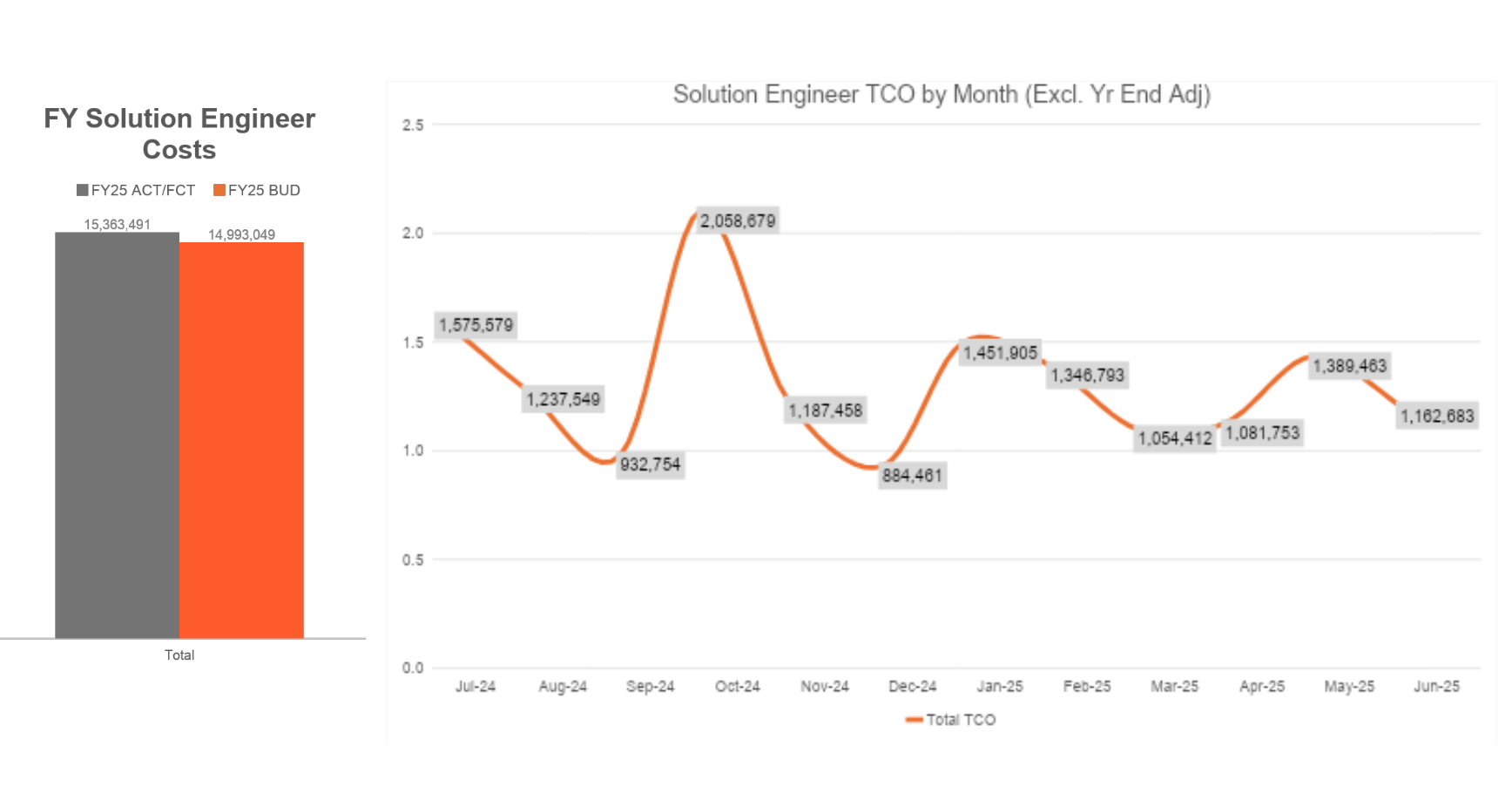

Develop and maintain dynamic, scalable financial models for forecasting, budget vs. actuals tracking, long-range planning, and investor reporting

Establish well-defined SOPs, improving data governance, and creating faster turnaround cycles to drive operational efficiency and reduce costs

Our methodical approach involved:

Existing Model Audit: Auditing and streamlining existing financial models

Custom Model Development: Developing tailored models for key processes like Monthly Reporting, Opex Reforecast, Payroll Forecasting, and Long-Range Planning

SOP Creation: Creating a comprehensive suite of SOPs covering model usage, data flow, monthly closes, and inter-departmental coordination

Scalable FP&A Transition: Gradually transitioning additional FP&A responsibilities to support scalable growth of the finance function

Through our engagement, the client achieved a 67% reduction in people costs on FP&A and improved accuracy. The new financial infrastructure enabled real-time visibility into forecasts, improved reporting accuracy, and significantly shortened turnaround times. The revamped FP&A framework continues to support client's growth, providing a scalable foundation for decision-making and strategic planning.

At AND, we served as a strategic partner in streamlining the client's finance operations without compromising agility. By combining practical business know-how with solid financial practices, we delivered a robust, future-ready FP&A framework—empowering the client to grow with confidence while staying aligned with their core priorities.

FP&A for global learning platforms involves developing dynamic financial models, establishing SOPs, and creating investor reporting frameworks to support scalable growth across multiple markets.

Data governance ensures consistent data sources, unified frameworks, and faster turnaround cycles, leading to operational efficiency and cost reduction in financial operations.

AND provides model auditing, custom model development, SOP creation, and scalable FP&A transition to help global platforms build robust financial operations.